In this article, we’ll look at how card linking technologies and card-linked offers have changed in several consumer industries and how the loyalty industry might be able to exploit them as an innovation.

Card linking, in essence, is a technological approach that allows for the tracking of specific transactions using the 16-digit card number of the consumer. Due to the emergence of card linked offers, card linking has gained popularity over the past ten years and is now most frequently utilised by retail banks. However, there are also significant uses in the retail, travel, and hospitality industries.

Why Do Cards Link?

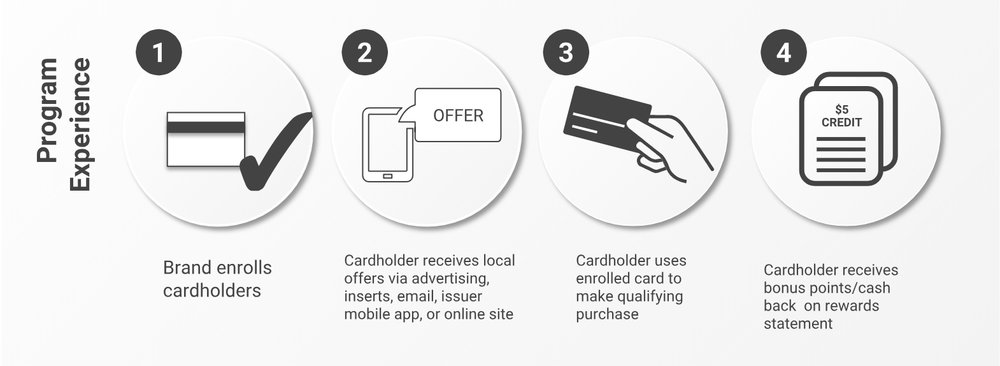

In terms of collecting each card transaction a consumer makes, there are significant benefits to tracking a customer’s transactions via their payment cards. The consumer experience is seamless: after registering their card, they’ll be qualified for offers of bonus points or cashback. In most programmes, customers can register numerous cards.

However, for obvious reasons, it does necessitate extensive data security precautions. Additionally, it depends on customer authorization to track transactions, which unnerves certain users. Because the bank has access to transactional data, the retail banking industry is where card linking is still most common. Cardlytics was the key force behind this industry, developing programmes with retail banks all over the world. However, a lot of companies are currently innovating in this field.

What Are the Benefits of Card Linking for Loyalty Programs?

For the loyalty sector, card linking technology has a variety of benefits. First off, since the consumer is identified by their card transaction, this technique does away with the necessity for a separate loyalty card to do so. As a result, there is never a missed card transaction, and the solution is excellent for an omnichannel interaction. Customers experience a frictionless journey as a result, allowing for the collection and analysis of a wide range of behaviours and interactions.

A company can develop a picture of a customer’s individual buying patterns and gain an incredibly detailed understanding of them if it can also correlate a customer’s transaction to the things in their cart.

All of these data points help the business comprehend a wider range of consumer behaviours as well as their unique wants and needs, which enables highly targeted and customised messaging. This offers a chance to increase advocacy, loyalty, and involvement.

Does Card Linking Work for Loyalty Programs in Any Industry?

Simply said, absolutely. This is a fairly new marketing technique that might improve any loyalty scheme. Brands ought to view card linking as a chance to promote a more specialised and financially advantageous method of client contact and offers.

Card linking provides real-time communications, highly targeted and tailored communication, and a frictionless customer experience.

In order to serve offers to the right client at the right time and through the right channel based on their prior actions, card linking data must be collected.

When a customer links their email address to their payment cards, electronic receipts can be automatically provided, which is a huge benefit for retail programmes.

As brands begin to expand their personalisation and targeting capabilities, this area will see an increase in activity. The necessity for businesses to reevaluate their loyalty offerings, re-set, evolve, and adapt to already-existing capabilities is what it really emphasises. Most significantly, it raises consumer expectations for how brands would employ these technological advancements to improve the buying experience.

Card Linked Offers: What Are They?

An offer that is tied to a card is one that targets clients and is based on their purchasing patterns. In other words, firms may essentially learn about a customer’s preferences by looking at their card transactions.

Since 2015’s big revisions to the law governing interchange rates, which had a significant impact on card issuers’ revenues, card-linked incentives have become a more common perk. This shift in how customers receive offers has a significant impact on consumers’ purchasing decisions. Retail banks can use this new service to interact with their customers and create a new source of income.

Using this service provided by the card issuers, merchants can target clients with highly specialised offers based on their buying patterns. Merchants can recruit consumers that they know are active in the industry and drive frequency and value extremely successfully. Additionally available are geolocation and time-of-day targeting, and, most importantly, this mechanism facilitates omnichannel behaviour.

But outside of the retail banking industry, it’s really just now beginning to integrate itself into the larger loyalty reward toolkit.

Discover the ideal answer for the future.

Card linking will be a step in the direction of deeper connections between businesses and their consumers in the future, according to our predictions. Card linking and offers that are linked to cards can enhance the customer experience and help brands better understand their target market.

Are you interested in learning more about the advanced, cutting-edge technical features of a loyalty programme? Please feel free to include us in your RFP or schedule a demo to speak with us.

Download our ebook about gamification if you’re interested in learning more about the most common customer retention strategies.