This article will demonstrate how to exploit the phenomenon of Mental Accounting to boost sales.

You will also discover:

How do Mental Budget Boundaries work?

practical advice on how to use Mental Accounting to highlight your product.

You will adore this article if you want to add some customer psychology to your marketing.

Please don your reading glasses before we continue.

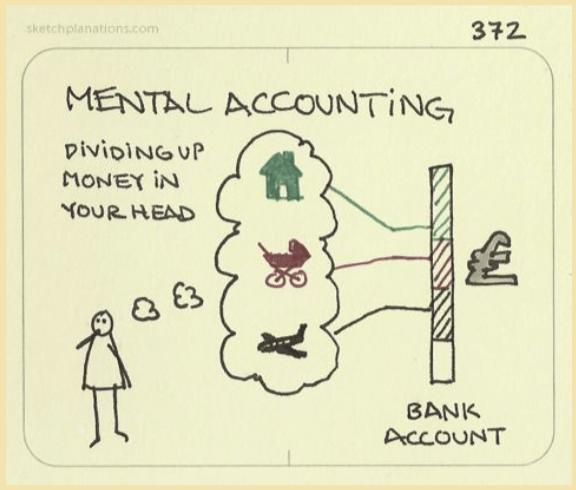

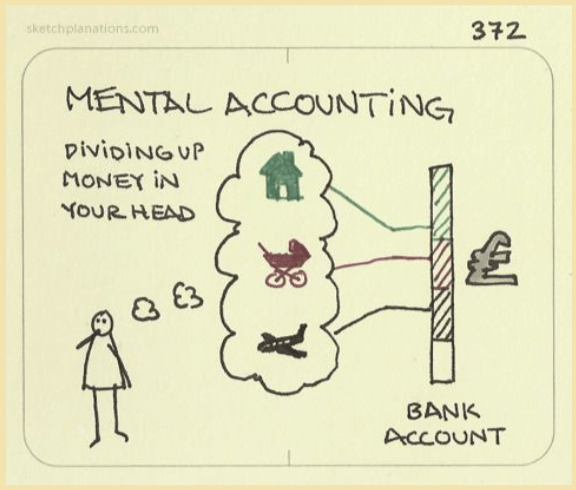

Even down to how they think about their money, people aren’t always good at managing their finances. Recognizing why and how your clients can create these “mental budgets” might help you better understand them. We have a tendency to organise and classify our income and expenses in ways that don’t necessarily result in the best financial decisions.

Everyone creates and maintains mental budgets, though some do so more frequently than others, and the fact that many shoppers feel at least a little compelled to divide their money into different categories has some intriguing implications (in behavioural economics, this is known as “Mental Accounting,” a term used to describe the collection of cognitive strategies and biases that emerge when people think about their money). Customers often attach predictable purposes to their money without even realising it because of this propensity to create various mental budgets.

Richard Thaler developed this idea in a paper published in 1985, and it has subsequently undergone significant development. Consumers automatically arrange their money into mental budgets and accounts, and they also feel as though those accounts have purpose, according to one of the surprise conclusions Thaler addressed regarding mental accounting. People are consequently reluctant to transfer funds from one of these fictitious budgets to another, which artificially exacerbates sentiments of financial restraint. In other words, buyers often refrain from making a purchase just because they believe there isn’t enough money in an imagined budget left over for it.

Mindful Financial Boundaries

Although consumers intentionally create budgets, this doesn’t necessarily indicate what those budgets are intended for. Consumers tend to have different budgets for entertainment, food, clothing, health, and parking fines, as demonstrated by Heath and Soll, but these categories are not set in stone. In actuality, they presumably differ greatly amongst individuals and depending on the circumstance. Additionally, different budget categories may overlap. For example, if a consumer divides their spending into “just for pleasure” and “necessities,” they will converge with their budgets for clothing or food (both of which could be used to buy either frivolous or necessary products).

Unexpectedly, people often classify their spending plans according to how they acquired the funds rather than how they intended to use them. Suzanne O’Curry, who studied this topic in an unpublished article, noted that customers consider the “seriousness” of money both when they receive it and when they spend it. Customers specifically aim to balance the importance of a purchase with the seriousness of their income.

For instance, customers are more motivated to spend money on needs if they are considering their income from a job, which is a significant source of revenue (a serious purchase). If they do receive a windfall, they would rather use it on something more frivolous. For instance, if you found $20 in a grocery store, you’d probably be more inclined to buy a treat than extra cleaning supplies.

Basics of Mental Accounting

It can be motivating for them if they comprehend how and why clients might organise and spend their money based on mental budgets. First and foremost, removing the impression that all purchases are being made from the same mental budget might help buyers feel less hesitant about making several purchases.

Recognizing mental budgets can help you improve your coupon or gift card offerings in addition to having consequences for your product offerings. Tell your consumers that they have “earned” coupons if your products tend to be more needs because the act of earning makes it appear like a more significant source of money. If your products are more frivolous, try to portray your coupons as a gift or as something that just happened to be provided to them. You might also offer discounts with hidden values, which are revealed only after the customer uses them. In addition to creating the impression that the coupon is a windfall, this also makes use of variable reinforcement one of the most effective methods for capturing people’s attention (and an underlying mechanism for the addictiveness of behaviours ranging from gambling to mobile gaming).

Takeaways

Consumers naturally set financial goals, therefore merchants must be aware of the budget or budgets they are targeting.

Customers may spend more when numerous budgets are catered to rather than if they feel like they are just spending from one budget.

When consumers think their money comes from a less serious or more enjoyable source, they favour more frivolous products over important ones, and the opposite is also true.

One response to “All You Need to Know About Mental Accounting”

An impressive share! I’ve just forwarded this onto a friend who was doing a little research on this. And he actually bought me breakfast because I stumbled upon it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanks for spending the time to discuss this subject here on your internet site.