Did you know that there has been an 89% increase in loyalty programme fraud in recent years? In addition to the obvious financial loss, exposing your incentive programme to fraud endangers the confidence of your customers in your company. They might stop using your product if their data is taken or if they receive punishment for unintentionally stumbling into an exploit. For these reasons, any company running a loyalty programme must include cutting-edge fraud detection methods.

Loyalty Fraud: Everything You Need to Know

Loyalty fraud, often known as loyalty programme fraud, is the exploitation of a reward program’s structure or rules for the perpetrator’s own gain. Customers discovering a way to use single-use coupons more than once or employees giving out points to friends in violation of the law are just a few examples. Additionally, since incentives and loyalty points have actual monetary worth, taking advantage of the system might be extremely harmful to programme owners.

The following categories can be used to classify loyalty programme fraud:

Fraud committed knowingly or unknowingly: Sometimes users simply run into an exploit without realising they’re doing so. Others make a special effort to find openings and weaknesses.

Fraud that occurs within as opposed to externally: Fraud can occur not just by customers or hackers. Your own employees may occasionally disobey the law by giving free gifts to family and friends.

Small-scale vs. large-scale loyalty fraud: Financial harm can result from loyalty fraud on either a small or large scale. A single person or small group may occasionally be responsible, earning hundreds of dollars in prizes and discounts.

Common Loyalty Program Fraud Types

Exploits of loyalty programmes can take thousands of different forms, and they are frequently simple to miss. One person may slip under your notice, but if they start sharing their findings on forums, other people might start abusing the system as well. But by that time, the harm has already been done.

Investigating your choices should be the first step in fraud prevention. It will be easier for you to close any potential gaps and vulnerabilities during implementation if you are aware of the many types of loyalty fraud that exist. Here are a handful of the most typical instances of loyalty fraud:

Customers can obtain an endless supply of welcome coupons by setting up proxy accounts.

During checkout, cashiers enter their own account details rather than those of the consumer.

Members frequently update their date of birth on the membership page to take advantage of birthday discounts after spending the points they earned with the transaction.

Even if they haven’t made any purchases, members have a lot of points on their accounts.

There has been a significant increase in reward points from one of your stores after business hours.

Due to their frequent and significant purchases of products, resellers join the programme and swiftly advance to the highest tier before abusing the service-based perks, such as free shipping.

The threat of employee fraud is growing

As the preceding instances demonstrate, sometimes employees harm a system more than hackers or exploiters. In 2020, internal events accounted for the third-most breaches, per Forrester’s analysis. Though not all of them begin with malice. In order to keep the line moving during rush hour, some cashiers may choose to use their own account information rather than taking the extra time to ask customers for their loyalty cards, a process that may require unprepared customers to dig through their wallets or search through their phones in search of their cards.

They might not be aware of it, but this is stealing—both from the brand and from the customers. When customers realise they are part of a loyalty programme and feel like they should have been given the chance to use their card, it can also make them lose faith in your company. Some employees might even get more audacious and begin actively stealing points from customers in order to claim incentives for themselves.

With a Next-Gen Loyalty Cloud, you can safeguard your reward system.

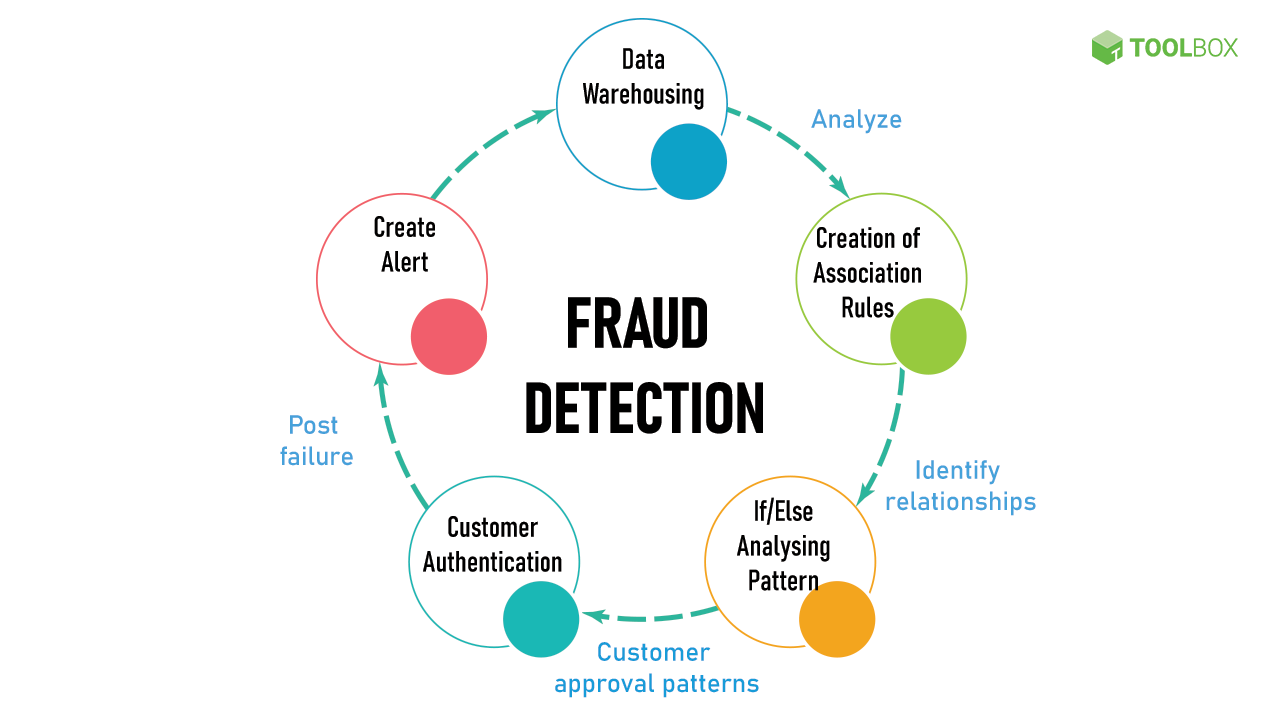

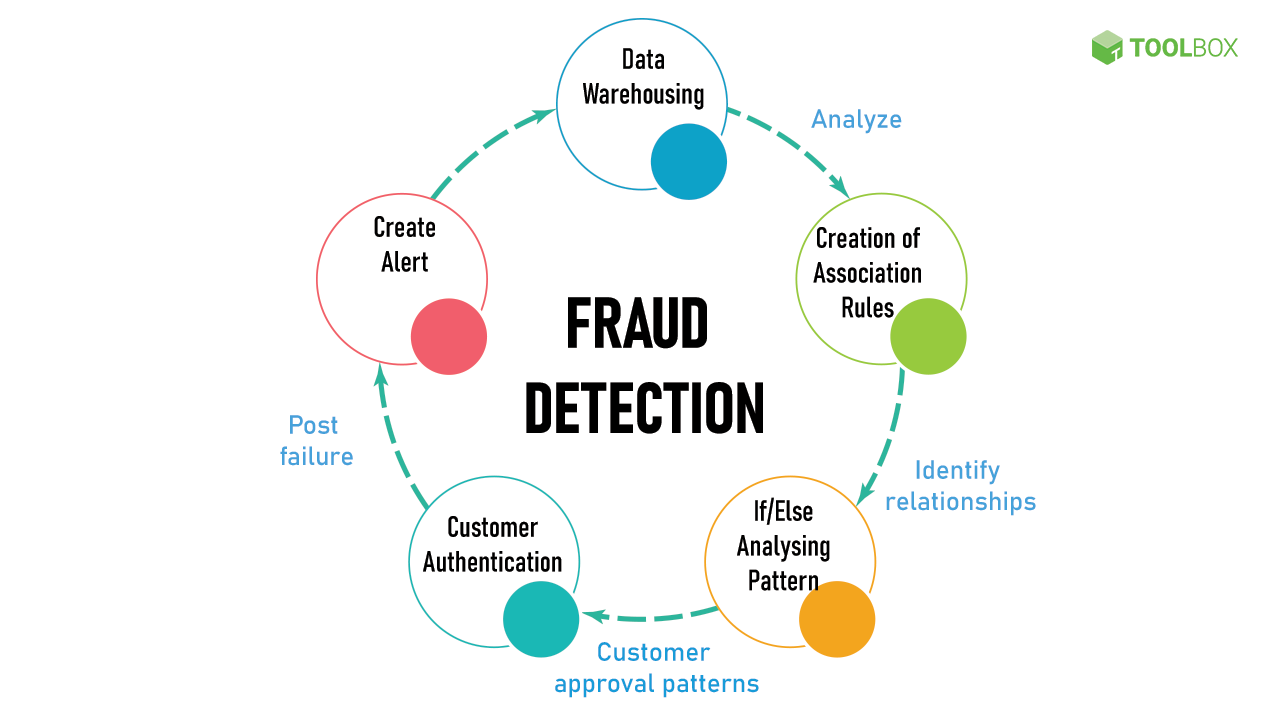

Loyalty fraud detection and prevention are continuous efforts. Your incentive system and technology are constantly evolving, and so is the risk of fraud. In order to keep one step ahead of fraudsters, you should always be at the top of your game and employ a versatile yet complex technology that can be changed to cover a wide range of scenarios.

Only a small portion of the capabilities of Antavo’s Loyalty Management Platform are covered in this Technology Explained article. Book a demo with one of our top loyalty experts or submit us your loyalty RFP if you’re interested in learning more about our technology as it relates to your specific company KPIs.